What began with individual products, now includes entire product ranges and industries, though the food industry remains somewhat niche. “The level of variety offered is growing everywhere we look,” observes Andreas Hartwig, a member of Miebach Consulting's management board, which specializes in intralogistics. There was a time when offering 100,000 items - a number reached at huge hardware stores or spare parts dealers – would have been considered market leading.

Germany's famous “Quelle” catalogue from the mail-order company of the same name, once featured 25,000 products. Amazon now offers over 4 million products, ready and waiting to be delivered. These products need to be stored, recorded and sorted from somewhere. And the online giant forces every other retailer to stock a large variety of products since they know customers are likely to walk away if the product they’re looking for isn’t available after they’ve spent time researching online.

Stocking a broader range of products

As Hartwig sees it, “Warehousing is being transformed. Most companies aren’t selling more; they’re just selling differently in smaller, distinct units.” In the past, shops would take deliveries in pack sizes of 12 or 20 items. However today, every customer wants their own personal toaster, special deodorant or a particular vegetable, whatever it might be.

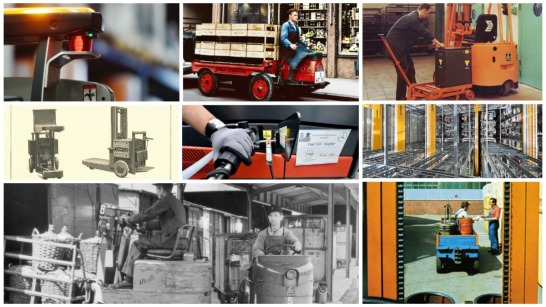

It also means that retailers find themselves needing fewer and fewer boxes and pallets. Is this a red flag for forklifts? After all, uniform packaging is practically their raison d’être. 'Yes' and 'no', responds Frank Schulze, who specializes in logistics at the University of Dresden. “We are still going to use Euro pallets going forward,” he confirms, but it will be restricted to a mere sub-section of the logistics process. Particularly when it comes to the large warehouse halls that belong to giant online retailers, an increasing number of processes will be automated in the future. Thus, the need for human intervention in warehouse logistics equipment will gradually diminish. The logistics expert also mentions a growing trend towards automation in the retail sector, as seen by the use of self-operating forklifts or tugger trains capable of navigating on their own. Asked what the industry wants most to see happen, Schulze replies, “enormous flexibility that can be scaled.”

Smaller, more flexible, more scalable

The combination of both trends - smaller sizes and partial automation - may mean that industrial vehicles will need to be smaller and more flexible in the future. “From a supplier’s point of view, I would be thinking about how trolleys and order pickers could be adapted to fit this kind of future,” says Hartwig.

Planning security is also apparently a high priority, explains Schulze, adding, “reliability is more important than speed. Retailers rest easy when they can safely plan ahead to have a product on the shelf the day after tomorrow.” When it comes to logistics, then, it is clear that he see sa trend towards “precision landing”.

In terms of the challenges faced by retailers, other key factors include space, labor costs and property prices. It is becoming increasingly common for showrooms and logistics centers to be located in completely different locations. “In the future, you might go into a showroom, find what you’re looking for, but then order it from a retailer's online site,” notes Schulze. In line with this trend, leading online retailers such as Amazon will consider opening physical stores in urban locations.

According to experts, tomorrow's customers will have two distinct buying behaviors: purchases that have undergone extensive deliberation, and others that are simply routine products. If someone is looking for a new TV or a particular bottle of wine, they will expect someone to be available at the shop to provide competent and friendly advice. However, when it comes to the routine purchases, such as skimmed milk or 4-ply toilet paper, many individuals will soon switch to ordering them online for home delivery. Even if the almost legendary, self-refilling refrigerator is still not quite a reality, the very concept remains as popular as ever.

“Sometimes innovations just need two or three trials,” notes Hartwig. For him, the situation is clear: if retailers want to remain successful, they must offer several purchasing channels and become innovative in themselves. “In any event, we are finding that retailers are putting a great deal of thought into intralogistics and supply chains.”